5 minutes

Credit line increase program sparks growth and rewards deserving members.

Sponsored by CSCU

The consensus across the financial industry is that we are operating in a competitive marketplace. However, those in the know understand that competition brings opportunity to grow to levels beyond what we thought possible. This was the sentiment expressed by Chris Slane, director of payments at $2.1 billion Chartway Federal Credit Union, Virginia Beach, Va.

"Credit unions are conservative," Slane notes. "There is a lot of risk aversion in the industry particularly regarding credit limit increases and members defaulting … but in order for us to elevate the industry, we have to be prepared to take the risks. We have to get beyond the narrative of evading any option which might impose a loss and start getting into the psychology of growth through strategic risk. We need to be willing to step out of our comfort zone and meet the members where they are."

Slane, along with Denise Bennett, the credit union's VISA consultant, shared the process that lead to a successful credit line increase program (CLIP) with their strategic partner, CSCU.

Change is Important for Growth

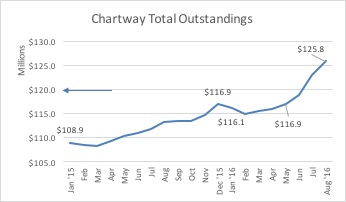

It had been several years since Chartway FCU offered members a broad-scale credit line increase program. A line increase in late 2014 had limited reach to qualified members and did not result in significant outstandings growth.

Having joined the team after Chartway FCU’s initial CLIP offering, Bennett surmises that "the previous line increase program was not comprehensive and systematic enough. It only included a very small portion of the portfolio, and the program didn’t maximize the credit opportunities based on the results from a tracking mechanism that was run to assess its effectiveness. As a result, Chartway knew going forward that measurement and reporting had to play an important role, as well as effective collaboration with their lending partners."

By 2016, CSCU’s comparative reporting had helped Chartway FCU determine that a more comprehensive CLIP was warranted. Its members’ line utilization far exceeded their peers. Higher-than-peer line utilization signified that deserving members were running out of spend runway, resulting in less spending power, less than optimal usage and perhaps members not thinking of Chartway FCU's card as "top of wallet." One of the most meaningful opportunities was to offer members the credit they deserved—opening up a tangible benefit to qualified members and increasing their ability to spend and borrow more with Chartway FCU. However, the approach to the increase had to be prudent and thoughtful, tying to the credit union's overall culture and brand theme: Life. Made Affordable.

"CSCU’s program put together all of the big pieces that we would have had to do on our own, which would be very costly, inefficient and time-consuming," notes Bennett. "The beauty of doing a CLIP with them is that the tracking and reporting is built-in. It provided us the ability to measure key metrics, present management with a solid ROI, and determine the extent of our success. Our CSCU consultant provided monthly reports with information that also compared our portfolio line utilization to that of our peers.

"CSCU did most of the heavy lifting. Chartway still had the responsibility and the control to review the accounts and the increases and to decide who we were going to grant increases to. CSCU, along with FIS and Twenty Twenty Analytics, made the process very streamlined," she adds.

Reporting Success

Chartway FCU’s outstandings went from $115 million at the end of 2015 to $133 million by the end of 2016. "We have very aggressive growth goals for outstandings, and without the CLIP we wouldn’t get there. We had an active portfolio of about 35,000 cards, and 21,000 cards qualified for an increase after scrubbing. Overall, the program was a success," says Bennett.

- Pre-CLIP balances $117 million

- 43,000 accounts reviewed

- 22,000 (51 percent) accounts qualified

- Post-CLIP balances of $126 million

Both Slane and Bennett agree that credit unions should have a competitive card product and a fulfilling member experience. "Right now, the market is so saturated with options," says Slane. "One way for us to retain and engage our members is giving them 'TLC.' So, benefits like increasing their credit line to provide them more purchasing power and improve card utilization ratios, which, by the way can improve members’ credit scores, is important."

Both Slane and Bennett agree that credit unions should have a competitive card product and a fulfilling member experience. "Right now, the market is so saturated with options," says Slane. "One way for us to retain and engage our members is giving them 'TLC.' So, benefits like increasing their credit line to provide them more purchasing power and improve card utilization ratios, which, by the way can improve members’ credit scores, is important."

"Positive customer experience should also focus on members growing as you grow—remembering to simply keep the member in the center," adds Bennett.

Chartway FCU wants to double its credit card business over the next five years. To achieve this, it knows that the card portfolio must keep evolving. It is the only way to maintain relevance in the industry. The CU also plans on maintaining their partnership with CSCU in executing its programs and encourage other credit unions that may have the same challenges to seek help.

"It is probably better to do it working with CSCU or an entity like CSCU, because there are regulatory concerns and CSCU has already ironed out the wrinkles," says Bennett. "I would have been concerned if we did it on our own. It’s like having a great tax consultant; if you are audited, it helps to know that you have a supportive, knowledgeable and fact-based partner by your side."

At CSCU, a leading provider of processing services to credit unions, we know about cards and payments. We deliver solutions to help simplify the increasingly complex world of payments. Through portfolio consulting, industry insights and thought leadership resources, our goal is to help credit unions not just survive, but thrive.