3 minutes

Potentially declining rates may not mean declining cost of funds.

Some credit unions likely breathed a sigh of relief when the upward climb of market rates stalled. Deposit pressures were building, and the cost of funds seemed positioned for a sharp increase. But with almost perfect timing, in came the Fed indicating no further rate increases in 2019. Rate decreases have even emerged as a possibility. While many have changed their market rate expectations, it is important not to go on cruise control. Flat or lower market rates may not translate to flat or lower cost of funds.

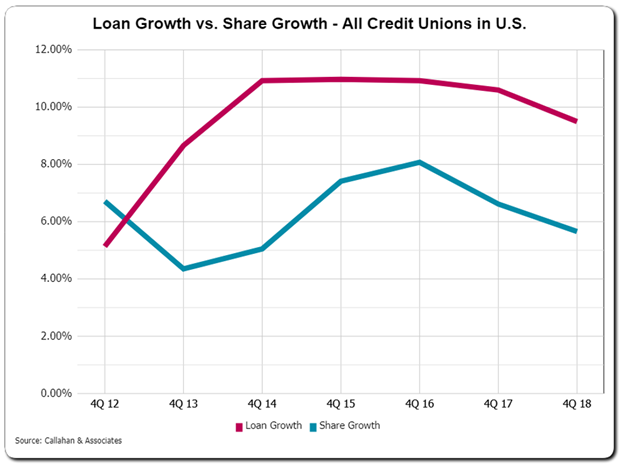

The primary contributor to this is a continuation of recent liquidity challenges. Sure, market interest rates play a key role in the cost of funds, but liquidity—or lack thereof—also has a significant impact. As shown in the graph below, loan growth has vastly outpaced share growth in recent years. This trend has caused some credit unions to dig deep into the liquidity toolbox for solutions.

Note: First quarter 2019 data indicates that loan growth continues to outpace share growth and that share growth shows an increase. Higher share growth is common in the first quarter and may not indicate a trend.

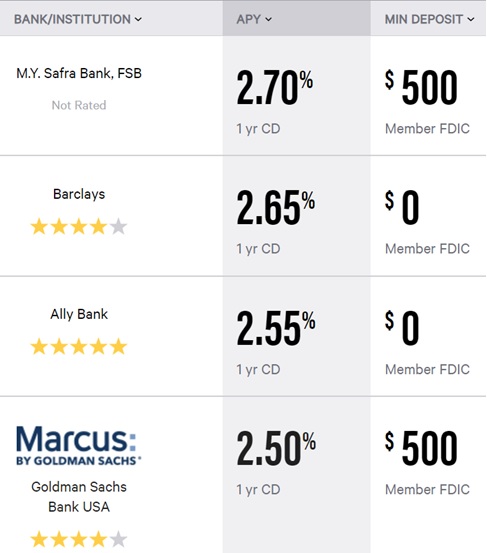

Based on the types of what-if scenarios requested from credit unions, member certificate promotions continue to be a popular liquidity tool to help replenish liquidity. While member certificates can be a quick alternative, it can come at a cost. Liquidity challenges have pushed certificate rates higher and, in many cases, certificate rates are higher than Treasury rates.

While there are plenty of credit unions feeling good about their deposit rates and overall liquidity positions, remember that high deposit rates from other institutions could cause members to move.

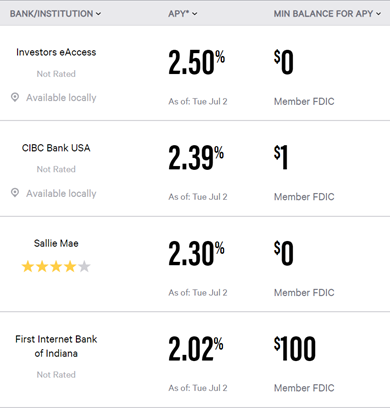

It is not just liquidity and high-cost liquidity solutions applying pressure to the cost of funds. Credit unions have also recently been performing what-if scenarios increasing money market rates. Why would money market rates increase if market interest rates are not increasing? Spurred in part by higher priced competition, one reason could be described as “catch-up” from being able to lag the increase in market interest rates. As short-term rates increased from essentially 0% to 2% the past few years, many credit unions were able to hold non-maturity deposit rates relatively flat over that period. As market rates potentially settle in at 2%, some catch-up may follow.

Potential increases in money market rates and ongoing liquidity pressures are just a few considerations currently impacting the cost of funds. Changes in technology, member behavior, and the overall economy will likely introduce a new host of factors in the future. While uncertainty remains, the key is in helping decision-makers understand that a potentially flat or decreasing rate environment may not translate into a flat or decreasing cost of funds.

We are seeing strategically-minded asset/liability committees and management teams view this as an opportunity to reassess their strategic positioning with respect to meeting short-term and intermediate funding needs.

c. myers corporation has partnered with credit unions since 1991. The company’s philosophy is based on helping clients ask the right, and often tough, questions in order to create a solid foundation that links strategy and desired financial performance. c myers has the experience of working with over 550 credit unions, including 50 percent of those over $1 billion in assets and about 25 percent over $100 million. They help credit unions think to differentiate and drive better decisions through real-time ALM decision information, CECL consulting, financial forecasting and consulting, liquidity services, strategic planning, strategic leadership development, process improvement, and project management.