4 minutes

Today’s credit union boards, while continuing to be faced with fiduciary issues of safety and soundness, are finding strategic choices more daunting, uncertain, and shifting frequently.

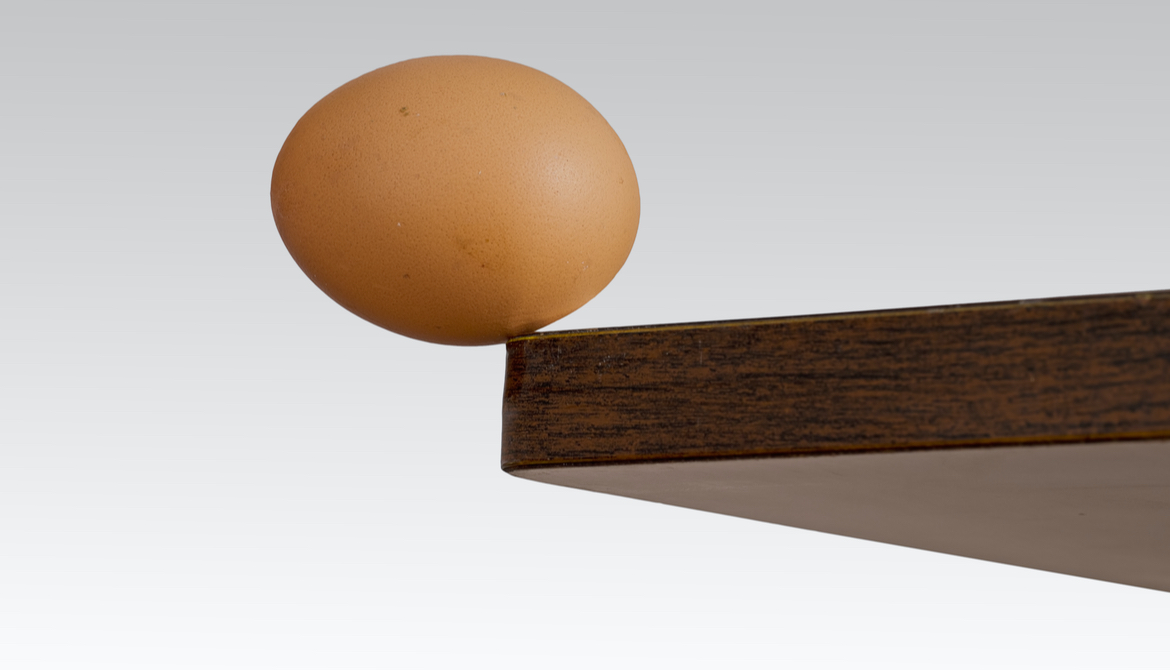

While this may sound like a relatively small shift, the 2002 book, “The Tipping Point: How Little Things Can Make a Difference,” points out that it is usually a small thing, piled on top of many other small things, that causes a big shift to happen. And indeed, credit union governance is at a tipping point: Today’s volunteer must become tomorrow’s trustee—a strategic asset to the enterprise.

To become more strategic, boards need to develop a profile of the types of experiences, background and competencies they believe the CU board will need over the next five years. This will include, but certainly not be limited to, having fiduciary knowledge. In addition, simply being a passionate member won’t be enough. It’s not that passion and commitment to the cooperative movement is not valuable; it’s that it’s insufficient to maintain the nimble, timely and strategic progress credit unions will need in the next decade.

The desired board profile should have specific experiences and competencies identified; applications to run for the board should specifically ask potential candidates about these. For example, each applicant should be asked to speak to their background with “strategic thinking/planning,” “leading transformation,” “sensing and interpreting the business environment,” “customer value creation and tracking,” “ERM,” and “complex enterprise oversight” to name a few.

To add value to decisions regarding credit unions’ future strategic choices, board members will need enterprise leadership experience at a higher level than having volunteered in another capacity or served as a front-line manager for an enterprise. Yes, boards must be able to adapt from what has been our old volunteer model to a new “qualified trustee” model. And this not should be training directors get after being elected to the board—trustees should be selected for their ability to hit the ground running.

How does this change the process by which boards encourage members to run for the board or select a replacement for a departing board member? Here’s where the new competencies we seek drive a slightly different process.

Certainly credit unions must broadly appeal to the members to encourage those interested in running for the board. However, a director job description should indicate the types of experiences and competencies that will be most helpful, and candidates should address these in their applications.

Indeed, in many cases the board should look beyond the current members for competencies that may be in short supply, but high value: e.g. experience with mergers, innovation and risk management. I’ve helped boards find “outside” board members who believe in the cooperative concept, are interested in helping, and are willing to become a member of the credit union so they qualify to serve on the board. This takes elbow grease; it will not occur spontaneously.

When the current board and executive team begin networking in the membership and the community with an “experience and competency profile” as a guide, it’s not unusual to find and quickly screen 15 potential candidates in 60 to 90 days. If your CU is in a more sparsely populated area, you may have to cast your net a bit wider. If it’s worth it to have a highly competent and experienced board overseeing CU success for the members, the work is not onerous.

Certainly this perspective and approach requires confronting a few sacred cows in the CU movement. Term limits, board members recruited from outside the current membership and raising the bar on business enterprise credentials all challenge current credit union norms. As we retire 30-year board members and elect a new chair more often than every 10 years, some people will be uncomfortable. Others will be happy to move off the board to make way for a more impressive slate of competencies and experience—I witness this happening every year with the credit unions with which I work.

While we’re revisiting the credit union board profile, we must consider the younger member. The response I get when I note that few boards have millennial-aged directors is “the younger professional with the credentials you suggest are hard to find and don’t have the time to serve.”

But I help clients find them every year with great success. The 30-something with enterprise business credentials is more available than conventional thinking may admit. These young people are also eager to build their leadership skills and broaden their portfolio with board service. Just a warning: They will not like the bureaucratic governance processes of many credit unions, and will change the conversation in the boardroom. I have found that to be a good thing.

So credit union governance is at a tipping point. Sudden change is taking place in board competency expectations, diversity and in the very conduct of governance. The business environment is not standing still, and the challenges and opportunities we face are forcing us to raise our game. Our members deserve the very best board we can recruit. Who will have the courage to raise this theme in your boardroom?

Les Wallace, Ph.D., is president of Signature Resources Inc. He is co-author of A Legacy of 21st Century Leadership and author of Principles of 21st Century Governance. He is a frequent speaker and consultant on leadership and governance.